Carbon: instant loans, free digital banking 8.2.1

Free Version

Publisher Description

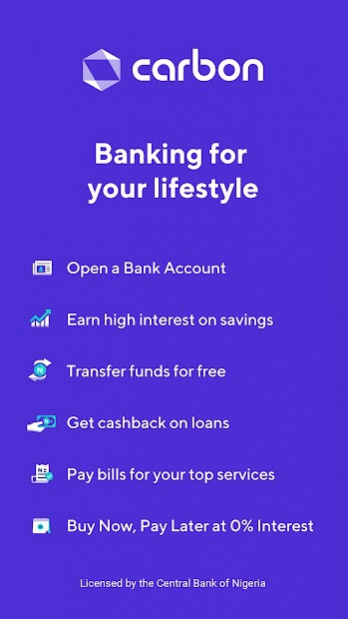

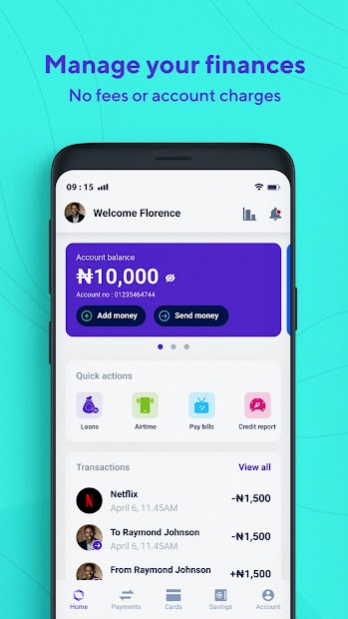

Carbon® lets you bank with ease. You can access a variety of banking services, invest money to earn high-interest returns, and get instant short-term loans for your urgent needs.

SPECIAL FEATURES

* Get loans ranging from ₦1,500 to ₦1m(Nigeria) and Ksh 500 to Ksh 30,000 (Kenya)

* Make repayments over a maximum of 64 weeks.

* Interest ranges from 1.75% - 30%, with an equivalent monthly interest rate of 1 - 21%.

* Annual Percentage Rate (APR) from 23% - 60.8%. No late fees or processing costs.

Example: For a 3-month loan of ₦50,000, Carbon charges 2% a month. With an APR of 24.3%, the total repayment amount after 90 days is ₦53,000.

Annual Percentage Rate (APR) from 23% - 60.8%. No late fees or processing costs.

Example: For a 3-month loan of ₦50,000, Carbon charges 2% a month. With an APR of 24.3%, the total repayment amount after 90 days is ₦53,000.

* Flexible tenors from 1 month to 6 months with the ability to make early repayments at any point in the tenor.

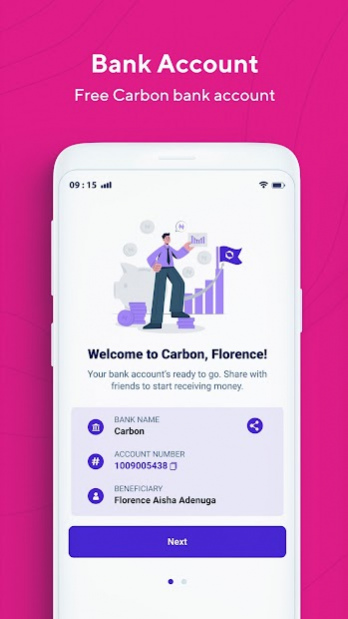

* Store money securely in your bank account. No account maintenance fees.

* Get instant loans 24/7. Cashback when you repay on time. Loan top-ups available. No late fees.

* Free funds transfer to any Nigerian bank account

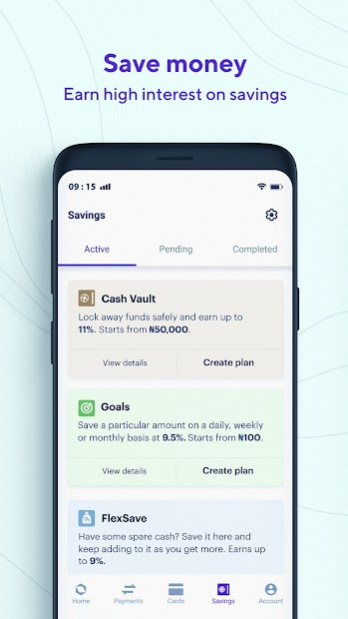

* Earn up to 11% interest on investments

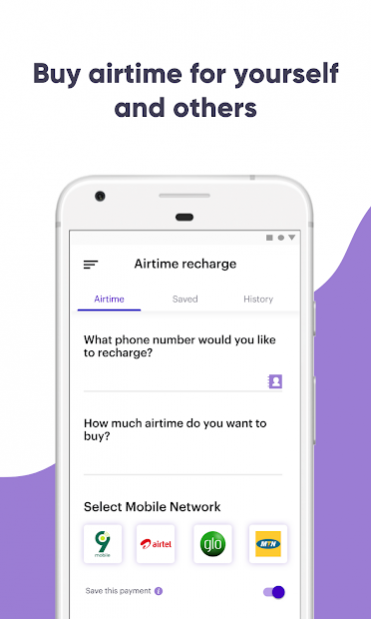

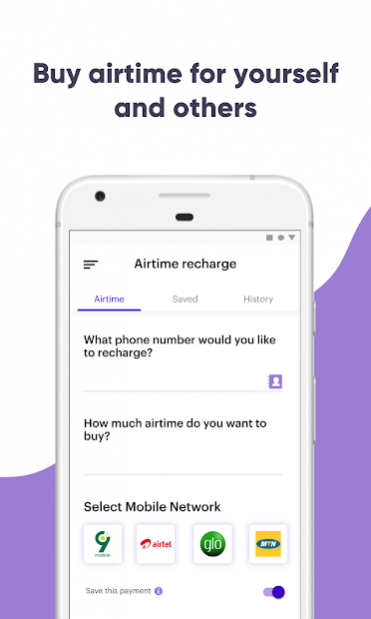

* Recharge airtime, buy data or pay your bills - all free

GETTING STARTED IS EASY

* Download the app

* Create your account in minutes

* Start transacting!

WHY CARBON?

With Carbon, easy financial transactions are always just a click away.

* No waiting times or stressful bank visits. Our service is available 24/7 - you can transact whenever and wherever you need it, right on your mobile device.

* Minimal requirements. Just have an Android device, a data connection, and a valid ID.

* You can get funds, no matter who you are. Whether you’re a student, salary earner, or self-employed, Carbon loans can help you achieve your goals.

* Monthly interest (2% per annum) on the funds in your Carbon account paid on the 1st of every month.

* We display all terms clearly before using any of our services. What you see is what you get. No hidden charges, ever.

* Get rewarded for positive actions. By repaying loans on time, performing transactions or saving regularly, or referring friends, you earn rewards on our platform such as larger loans, better rates, and free cash!

GET IN TOUCH WITH US!

Carbon is a service provided by a fully licensed and regulated microfinance bank. While we offer a service that is 100% online, you can always reach us and learn more about our service via the following channels:

* Email us at customer@getcarbon.co

* Like our Facebook page: www.facebook.com/getcarbon

* Follow us on Twitter: www.twitter.com/get_carbon

* Double-tap our pictures on Instagram: www.instagram.com/getcarbon

* Read our blog: www.medium.com/@getcarbon

* Visit our website: www.getcarbon.co

We’d love to hear from you!

-----------------------------------------------

ADDITIONAL INFORMATION

-----------------------------------------------

PRIVACY AND PERMISSIONS

When you download Carbon, we will ask for your permission to scan your financial SMS data and other information in order to verify your identity, creditworthiness, and provide you with an instant loan. We also use this to help you better understand and improve your finances with our personal finance manager. We take privacy seriously - all data you choose to share with us is encrypted and your personal data will never be shared without your consent.

CREDIT SCORE IMPACT

Failure to pay off any loans taken triggers a notice to the consumer credit reporting agency which would negatively impact an individual’s credit score. Late payments can also affect your ability to borrow in the future, so please ensure timely repayments of obligations.

Please do not take a Carbon loan to service long-term debts. Short-term loans are extremely helpful in emergency cases, but can be costly if compared with other types of loans and should be used with care. You can find out more on www.getcarbon.co

About Carbon: instant loans, free digital banking

Carbon: instant loans, free digital banking is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Carbon: instant loans, free digital banking is Carbon Finance & Investments Ltd. The latest version released by its developer is 8.2.1. This app was rated by 22 users of our site and has an average rating of 3.2.

To install Carbon: instant loans, free digital banking on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2021-08-24 and was downloaded 8,855 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Carbon: instant loans, free digital banking as malware as malware if the download link to com.lenddo.mobile.paylater is broken.

How to install Carbon: instant loans, free digital banking on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Carbon: instant loans, free digital banking is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Carbon: instant loans, free digital banking will be shown. Click on Accept to continue the process.

- Carbon: instant loans, free digital banking will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.